The bull market remains intact, and the opportunity set heading into 2026 is plentiful.

2025 delivered another year of strong equity performance, with the S&P 500 up roughly 16% and the Nasdaq 100 gaining nearly 21% as of this writing. As in recent years, artificial intelligence was a key driver of returns, cementing itself as the most important business and technological shift since the internet. And it wasn’t just hype. Steady sales and earnings growth and ample liquidity also played a meaningful role in supporting asset prices.

While equities posted healthy gains, the standout asset in 2025 was gold. Bullion rose approximately 68%, with gold mining stocks delivering multiples of that return. In contrast, Bitcoin declined roughly 5% over the year despite its growing prominence in institutional portfolios.

Looking ahead, there are few signs of an imminent economic slowdown. At the same time, the K-shaped nature of the economy remains a key tension, as elevated living costs for households stand in stark contrast to booming asset markets.

For investors, aligning portfolios with the durable economic megatrends has been a winning strategy. Technological innovation, geopolitical uncertainty, and abundant liquidity have driven returns in recent years, and we expect these forces to remain central as we move into 2026.

2026 Stock Market Outlook: Key Takeaways

Big Tech remains dominant – The largest technology platforms continue to combine strong revenue growth, rising profitability, and elevated yet defensible valuations. Growth opportunities continue to expand into adjacent areas such as cloud, wearables, autonomous driving, robotics, and other emerging technologies.

AI buildout continues; applications begin to surface – The AI infrastructure cycle is far from complete. The current phase still resembles the late-1990s infrastructure buildout, while early enterprise use cases are gaining traction and consumer-facing applications remain in their infancy.

Solar emerges as a quiet outperformer – Despite political headwinds, solar has shown notable relative strength. Economics continue to improve as panel efficiency and battery technology advance, making solar the fastest growing and most scalable source of new energy at a time when electricity demand is soaring.

Oil and gas remain essential – Natural gas demand is accelerating, while sentiment toward oil is near cyclical lows. Together, they remain critical pillars of the global energy system, despite the transition to alternative energy sources.

Gold and Bitcoin as monetary hedges – Central banks and institutional allocators continue to seek diversification amid rising geopolitical uncertainty. The gold bull market appears intact, and Bitcoin has historically delivered strong performance following down years.

Healthcare and biotech set up for a rebound – After years of underperformance, valuations and innovation trends are becoming more attractive. In the final quarter of the year, healthcare delivered notable market outperformance, a signal that investors are rotating back into the sector.

Core Economic Drivers of the 2026 Bull Market in Stocks

AI capital expenditures – Global AI-related capex is projected to exceed $500 billion, reflecting an ongoing, multi-year infrastructure buildout. Spending on data centers, compute, networking, and power remains a primary engine of investment and earnings growth across technology and industrial supply chains.

Abundant liquidity – Large fiscal deficits and an increasingly accommodative monetary backdrop continue to support risk assets. With the administration openly favoring lower rates and a more growth-tolerant Federal Reserve leadership, policy is biased toward keeping financial conditions loose.

Elevated geopolitical uncertainty – Ongoing tensions involving Russia and China, alongside a persistent cost-of-living crisis, continue to shape capital flows, investor behavior, and social cohesion.

Keep reading . . .

------------------------------------------------------------------------------------------------------

New Report: 2026 Profit Predictions

Zacks’ just-released Special Report reveals a handful of surprising picks predicted to skyrocket in 2026 – including what may be the most transformative application of AI technology yet.

This year, our team of experts closed gains such as +499%, +1,340% and +2,027%.¹ We anticipate our 2026 predictions will rival or even surpass this performance.

Be among the first to see our profit predictions for 2026 >>

------------------------------------------------------------------------------------------------------

Magnificent Seven Stocks Continue to Drive Market Leadership

The durability of the Magnificent Seven continues to stand out. Despite their immense scale, these companies still post growth rates that would be impressive for businesses a fraction of their size. Their competitive advantages, network effects, data dominance, and balance sheet strength remain intact. Forward growth expectations continue to reset higher.

These companies sit at the center of many of the world’s most essential and fastest-growing industries: cloud computing, digital advertising, semiconductors, electric vehicles, e-commerce, mobile devices, and enterprise software. The addition of generative AI meaningfully expands this opportunity set, both as a standalone product category and as a powerful driver of productivity gains. AI is not only creating new revenue streams, but also enhancing operating leverage by improving efficiency, and accelerating innovation across existing platforms.

According to Zacks Head of Research Sheraz Mian, total 2026 earnings for the Magnificent Seven are expected to rise 16.5% on 15% revenue growth, following estimated 2025 earnings growth of 21.7% on 11.9% higher revenues. While AI-related capital expenditures are temporarily pressuring margins, the data points to an acceleration in top-line growth and a deliberate reinvestment cycle rather than structural profitability erosion.

Earnings growth is also broadening beyond the Magnificent Seven. Earnings for the rest of the S&P 500 are projected to grow 10.8% in 2026, up from 8.3% in 2025, 4.4% in 2024, and a 4.8% decline in 2023. This steady improvement undercuts concerns about overly narrow market leadership and suggests a healthier, more durable earnings backdrop.

Image Source: Zacks Investment Research

Over the long term, the Magnificent Seven have compounded shareholder value at truly historic rates. As global pools of capital continue to expand, these dominant franchises are likely to remain natural destinations for both institutional and individual investor flows in 2026 and beyond.

The Next Phase of the AI Boom

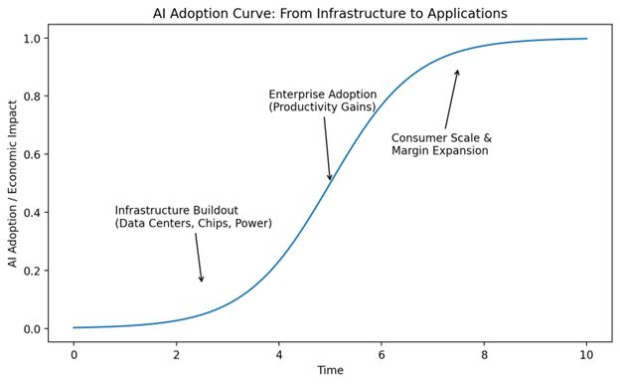

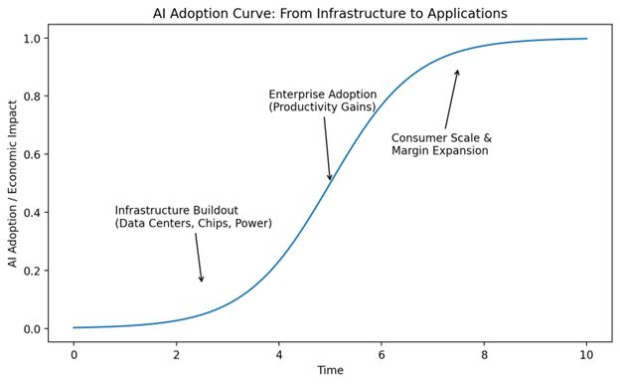

Artificial intelligence has dominated market discussion for the past three years, yet the opportunity set continues to expand. We remain firmly in the infrastructure buildout phase, and the leading players in that layer should continue to benefit. Even within this phase, leadership has rotated across sub-verticals. The cycle began with Nvidia’s dominance in GPUs and Vertiv’s role in data center infrastructure, then broadened to custom silicon through companies like Broadcom and to power providers such as Bloom Energy as energy constraints moved to the forefront.

As total AI-related capital expenditures approach $1 trillion, additional opportunities across the infrastructure stack are likely to emerge. However, this phase represents only the foundation of the AI cycle. Historically, major productivity revolutions deliver their largest economic and earnings impact after the physical infrastructure is in place. Most large enterprises remain in early-stage experimentation with AI, suggesting that meaningful productivity gains and margin expansion still lie ahead.

Image Source: Zacks Investment Research

As the buildout matures, the opportunity set should increasingly shift from hardware and power toward software, services, and monetization. Enterprise AI adoption is still in its early innings, and consumer-facing applications remain underpenetrated. As interfaces improve and AI becomes more deeply embedded into daily workflows, adoption is likely to follow a trajectory similar to smartphones or cloud software – initially novel, then indispensable.

Importantly, while early AI investment has been somewhat margin-dilutive due to heavy capital spending, the next phase should be margin-accretive. AI-driven automation, labor substitution, and improved operational efficiency have the potential to structurally raise profitability across a wide range of industries. As adoption broadens across sectors and geographies, the AI boom is poised to evolve from an infrastructure-led cycle into a durable, economy-wide productivity engine, where the creativity of entrepreneurs and the scalability of software ultimately drive the largest long-term gains.

Solar Energy Stocks and the Power Boom

While solar has long been economically marginal, that reality has shifted meaningfully in recent years as the underlying technology and cost structure have improved, and perception is slowly following suit.

Solar is now among the cheapest sources of new power generation across much of the United States, driven by dramatic efficiency gains. At the same time, the urgency for scalable, quickly deployable energy has intensified as electricity demand rises for the first time in decades.

Cost declines have been the game changer. Over the past decade, photovoltaic module costs have fallen by roughly 90%. In many high-irradiance regions, solar is already cheaper than coal or natural gas.

Storage technology has also reached a critical inflection point. Lithium-ion battery pack costs declined another 20% over the past year, reaching a record low of approximately $108 per kilowatt-hour. With battery costs down nearly 90% over the past decade, pairing solar with storage is increasingly viable, enabling more consistent, round-the-clock power delivery and materially improving Solar’s reliability profile.

This shift has begun to register in markets, with the sector outperforming the broader market in 2H’25.

Oil and Gas Stocks Forming a Bottom

Over the past several years, the oil market has been defined by a shifting power dynamic. Abundant non-OPEC+ supply, driven by US production growth and the rapid development of Guyana’s fields have changed the leverage dynamics and limited OPEC’s ability to bully the market. That said, the bloc still moves the market. At its most recent meeting, it changed course, pausing planned output increases and signaling a move away from aggressive market-share gains toward price defense.

Absent a full-blown economic slowdown, oil now appears to be forming a floor. Even after a fresh wave of bearish headlines pushed crude to new multi-year lows, prices failed to stay down and quickly reversed back above key support. Last week’s sharp reversal and rising buying pressure suggest a potential final capitulation phase, after which bearish expectations may begin to unwind.

Image Source: TradingView

Oil equities have been severe underperformers for roughly three years, leaving sentiment washed out and valuations compelling.

Natural gas, by contrast, is already in a different phase of the cycle. Gas has rapidly become one of the dominant sources of utility-scale energy. After entering a clear bull market, natural gas prices underwent a sharp correction in the last couple of weeks, but the setup still favors another leg higher. Storage trends, expanding LNG exports, colder-than-normal seasonal patterns, and surging electricity demand from AI data centers are tightening the market faster than expected.

With US LNG export capacity set to expand meaningfully and domestic demand rising, natural gas has become a structurally bullish story. The divergence, oil potentially bottoming while gas remains in a bull trend, creates an attractive risk-reward backdrop across the energy complex.

Gold and Bitcoin: Alternatives in an Uncertain World

Gold has quietly delivered a remarkable run, rising nearly 70% this year and more than doubling the S&P 500’s return since the start of the AI boom roughly three years ago. That performance is discussed surprisingly little, which itself suggests gold remains under owned. Investor reactions to gold tend to be polarized, ranging from ardent gold bugs to purists who dismiss any asset without earnings. In reality, gold’s role is more nuanced. It functions best as a portfolio diversifier rather than a growth asset.

Bitcoin occupies a similar psychological space. It also provokes emotional reactions, yet it too has emerged as a legitimate and increasingly important diversifier. Both assets reflect the broader and somewhat uncomfortable reality that the world has become markedly more uncertain. From a portfolio construction standpoint, guarding against what can go wrong has become more important, and historically, gold has been one of the most effective hedges against complex risks.

Despite the lack of retail enthusiasm, gold clearly has strong buyers. Central banks and more recently, large institutions have returned aggressively to the metal. Gold performed well through COVID and has gained renewed appeal amid rising geopolitical tensions.

Morgan Stanley CIO Michael Wilson recently argued that the traditional 60/40 stock-bond portfolio no longer reflects today’s market realities and suggested a 60/20/20 approach, replacing half of the bond allocation with gold. As Wilson put it, “Gold is now the anti-fragile asset to own, rather than Treasuries. High-quality equities and gold are the best hedges."

Yet retail investors remain largely disengaged from the gold discussion. That lack of enthusiasm is itself a constructive signal. Historically, gold bull markets tend to peak only after widespread retail excitement. When newcomers begin loudly touting gold at new highs, that will be a reason for caution. That phase appears some distance away.

Bitcoin has emerged as a parallel alternative for hedging risk while also offering higher return potential. The “digital gold” narrative is increasingly compelling.

In just over a decade, Bitcoin has moved from an obscure experiment to a holding recommended by the world’s largest asset managers. It serves as an alternative store of value with overlapping catalysts to gold, remains insulated from direct government manipulation, and increasingly acts as a release valve for global liquidity.

While future returns are unlikely to match the multi-hundred-percent gains of earlier years, Bitcoin still appears early in its adoption cycle.

It’s worth noting that Bitcoin has never had two consecutive years of annual losses.

Healthcare

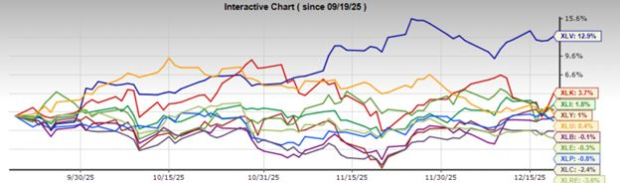

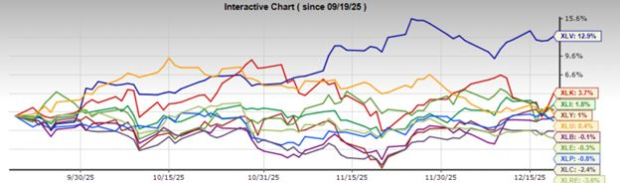

Healthcare stocks delivered meaningful outperformance in the final quarter of the year, driven by a combination of defensive rotation and genuine fundamental improvement. As volatility increased, investors gravitated toward sectors with stable demand and earnings visibility. Importantly, even as volatility has eased, healthcare names have held their gains and appear well positioned to resume their advance after consolidating near recent highs.

The Healthcare ETF (XLV) posted standout relative performance versus nearly every other sector over the past three months. Three-month relative momentum is among the more reliable short-to-intermediate forward indicators in markets, and in this case it appears supported by fundamentals that can extend into next year rather than fade quickly.

Image Source: Zacks Investment Research

Defensive demand, improving earnings visibility, regulatory clarity, and AI-enhanced productivity, healthcare’s recent strength looks structurally supported. Momentum is strong, but importantly, it is being carried by fundamentals that suggest durability rather than exhaustion.

What Can Investors Expect in the Year Ahead

The investment backdrop heading into 2026 remains constructive. While volatility and periodic drawdowns are inevitable, the core drivers of the bull market remain firmly in place. Leadership is broadening, earnings growth is improving beyond mega-cap technology, and multiple sectors are setting up for durable advances.

For investors, the opportunity is less about predicting short-term market moves and more about aligning with the dominant forces reshaping the global economy. AI-driven productivity gains, the re-pricing of energy and power assets, and improving fundamentals in historically cyclical sectors all point to a market rich in opportunity.

As promising as these trends are, it’s important to identify the companies with the highest probabilities of outsized gains.

That's why we've just released our new Special Report, 2026 Profit Predictions: 4 Big Opportunities. It explores the surprising stocks we believe will skyrocket in the new year and explains the cutting-edge advancements and key catalysts that make them impossible to ignore.

Looking back at this year, our team closed gains such as +499%, +1,340% and +2,027%.¹ Our latest recommendations may be just as lucrative.

Today you can access the 2026 Profit Predictions Special Report today for just $1. When you do, you'll also get 30-day access to all of Zacks private portfolios for the same dollar.

We're limiting the number of investors who can download our Special Report, so don’t delay. This opportunity will end midnight Saturday, December 28.

Download 2026 Profit Predictions and check out Zacks' portfolios for 30 days for just $1 >>

All the best,

Ethan

Ethan Feller is a Stock Strategist with more than a decade of experience. He invites you to access Zacks 2026 Profit Predictions to learn more about the trends and trades Zacks expects to dominate the new year – for a total cost of only $1.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position. Access grants you a comprehensive list of all open and closed trades.

Image: Bigstock

6 Major Investment Themes Shaping 2026

The bull market remains intact, and the opportunity set heading into 2026 is plentiful.

2025 delivered another year of strong equity performance, with the S&P 500 up roughly 16% and the Nasdaq 100 gaining nearly 21% as of this writing. As in recent years, artificial intelligence was a key driver of returns, cementing itself as the most important business and technological shift since the internet. And it wasn’t just hype. Steady sales and earnings growth and ample liquidity also played a meaningful role in supporting asset prices.

While equities posted healthy gains, the standout asset in 2025 was gold. Bullion rose approximately 68%, with gold mining stocks delivering multiples of that return. In contrast, Bitcoin declined roughly 5% over the year despite its growing prominence in institutional portfolios.

Looking ahead, there are few signs of an imminent economic slowdown. At the same time, the K-shaped nature of the economy remains a key tension, as elevated living costs for households stand in stark contrast to booming asset markets.

For investors, aligning portfolios with the durable economic megatrends has been a winning strategy. Technological innovation, geopolitical uncertainty, and abundant liquidity have driven returns in recent years, and we expect these forces to remain central as we move into 2026.

2026 Stock Market Outlook: Key Takeaways

Big Tech remains dominant – The largest technology platforms continue to combine strong revenue growth, rising profitability, and elevated yet defensible valuations. Growth opportunities continue to expand into adjacent areas such as cloud, wearables, autonomous driving, robotics, and other emerging technologies.

AI buildout continues; applications begin to surface – The AI infrastructure cycle is far from complete. The current phase still resembles the late-1990s infrastructure buildout, while early enterprise use cases are gaining traction and consumer-facing applications remain in their infancy.

Solar emerges as a quiet outperformer – Despite political headwinds, solar has shown notable relative strength. Economics continue to improve as panel efficiency and battery technology advance, making solar the fastest growing and most scalable source of new energy at a time when electricity demand is soaring.

Oil and gas remain essential – Natural gas demand is accelerating, while sentiment toward oil is near cyclical lows. Together, they remain critical pillars of the global energy system, despite the transition to alternative energy sources.

Gold and Bitcoin as monetary hedges – Central banks and institutional allocators continue to seek diversification amid rising geopolitical uncertainty. The gold bull market appears intact, and Bitcoin has historically delivered strong performance following down years.

Healthcare and biotech set up for a rebound – After years of underperformance, valuations and innovation trends are becoming more attractive. In the final quarter of the year, healthcare delivered notable market outperformance, a signal that investors are rotating back into the sector.

Core Economic Drivers of the 2026 Bull Market in Stocks

AI capital expenditures – Global AI-related capex is projected to exceed $500 billion, reflecting an ongoing, multi-year infrastructure buildout. Spending on data centers, compute, networking, and power remains a primary engine of investment and earnings growth across technology and industrial supply chains.

Abundant liquidity – Large fiscal deficits and an increasingly accommodative monetary backdrop continue to support risk assets. With the administration openly favoring lower rates and a more growth-tolerant Federal Reserve leadership, policy is biased toward keeping financial conditions loose.

Elevated geopolitical uncertainty – Ongoing tensions involving Russia and China, alongside a persistent cost-of-living crisis, continue to shape capital flows, investor behavior, and social cohesion.

Keep reading . . .

------------------------------------------------------------------------------------------------------

New Report: 2026 Profit Predictions

Zacks’ just-released Special Report reveals a handful of surprising picks predicted to skyrocket in 2026 – including what may be the most transformative application of AI technology yet.

This year, our team of experts closed gains such as +499%, +1,340% and +2,027%.¹ We anticipate our 2026 predictions will rival or even surpass this performance.

Be among the first to see our profit predictions for 2026 >>

------------------------------------------------------------------------------------------------------

Magnificent Seven Stocks Continue to Drive Market Leadership

The durability of the Magnificent Seven continues to stand out. Despite their immense scale, these companies still post growth rates that would be impressive for businesses a fraction of their size. Their competitive advantages, network effects, data dominance, and balance sheet strength remain intact. Forward growth expectations continue to reset higher.

These companies sit at the center of many of the world’s most essential and fastest-growing industries: cloud computing, digital advertising, semiconductors, electric vehicles, e-commerce, mobile devices, and enterprise software. The addition of generative AI meaningfully expands this opportunity set, both as a standalone product category and as a powerful driver of productivity gains. AI is not only creating new revenue streams, but also enhancing operating leverage by improving efficiency, and accelerating innovation across existing platforms.

According to Zacks Head of Research Sheraz Mian, total 2026 earnings for the Magnificent Seven are expected to rise 16.5% on 15% revenue growth, following estimated 2025 earnings growth of 21.7% on 11.9% higher revenues. While AI-related capital expenditures are temporarily pressuring margins, the data points to an acceleration in top-line growth and a deliberate reinvestment cycle rather than structural profitability erosion.

Earnings growth is also broadening beyond the Magnificent Seven. Earnings for the rest of the S&P 500 are projected to grow 10.8% in 2026, up from 8.3% in 2025, 4.4% in 2024, and a 4.8% decline in 2023. This steady improvement undercuts concerns about overly narrow market leadership and suggests a healthier, more durable earnings backdrop.

Image Source: Zacks Investment Research

Over the long term, the Magnificent Seven have compounded shareholder value at truly historic rates. As global pools of capital continue to expand, these dominant franchises are likely to remain natural destinations for both institutional and individual investor flows in 2026 and beyond.

The Next Phase of the AI Boom

Artificial intelligence has dominated market discussion for the past three years, yet the opportunity set continues to expand. We remain firmly in the infrastructure buildout phase, and the leading players in that layer should continue to benefit. Even within this phase, leadership has rotated across sub-verticals. The cycle began with Nvidia’s dominance in GPUs and Vertiv’s role in data center infrastructure, then broadened to custom silicon through companies like Broadcom and to power providers such as Bloom Energy as energy constraints moved to the forefront.

As total AI-related capital expenditures approach $1 trillion, additional opportunities across the infrastructure stack are likely to emerge. However, this phase represents only the foundation of the AI cycle. Historically, major productivity revolutions deliver their largest economic and earnings impact after the physical infrastructure is in place. Most large enterprises remain in early-stage experimentation with AI, suggesting that meaningful productivity gains and margin expansion still lie ahead.

Image Source: Zacks Investment Research

As the buildout matures, the opportunity set should increasingly shift from hardware and power toward software, services, and monetization. Enterprise AI adoption is still in its early innings, and consumer-facing applications remain underpenetrated. As interfaces improve and AI becomes more deeply embedded into daily workflows, adoption is likely to follow a trajectory similar to smartphones or cloud software – initially novel, then indispensable.

Importantly, while early AI investment has been somewhat margin-dilutive due to heavy capital spending, the next phase should be margin-accretive. AI-driven automation, labor substitution, and improved operational efficiency have the potential to structurally raise profitability across a wide range of industries. As adoption broadens across sectors and geographies, the AI boom is poised to evolve from an infrastructure-led cycle into a durable, economy-wide productivity engine, where the creativity of entrepreneurs and the scalability of software ultimately drive the largest long-term gains.

Solar Energy Stocks and the Power Boom

While solar has long been economically marginal, that reality has shifted meaningfully in recent years as the underlying technology and cost structure have improved, and perception is slowly following suit.

Solar is now among the cheapest sources of new power generation across much of the United States, driven by dramatic efficiency gains. At the same time, the urgency for scalable, quickly deployable energy has intensified as electricity demand rises for the first time in decades.

Cost declines have been the game changer. Over the past decade, photovoltaic module costs have fallen by roughly 90%. In many high-irradiance regions, solar is already cheaper than coal or natural gas.

Storage technology has also reached a critical inflection point. Lithium-ion battery pack costs declined another 20% over the past year, reaching a record low of approximately $108 per kilowatt-hour. With battery costs down nearly 90% over the past decade, pairing solar with storage is increasingly viable, enabling more consistent, round-the-clock power delivery and materially improving Solar’s reliability profile.

This shift has begun to register in markets, with the sector outperforming the broader market in 2H’25.

Oil and Gas Stocks Forming a Bottom

Over the past several years, the oil market has been defined by a shifting power dynamic. Abundant non-OPEC+ supply, driven by US production growth and the rapid development of Guyana’s fields have changed the leverage dynamics and limited OPEC’s ability to bully the market. That said, the bloc still moves the market. At its most recent meeting, it changed course, pausing planned output increases and signaling a move away from aggressive market-share gains toward price defense.

Absent a full-blown economic slowdown, oil now appears to be forming a floor. Even after a fresh wave of bearish headlines pushed crude to new multi-year lows, prices failed to stay down and quickly reversed back above key support. Last week’s sharp reversal and rising buying pressure suggest a potential final capitulation phase, after which bearish expectations may begin to unwind.

Image Source: TradingView

Oil equities have been severe underperformers for roughly three years, leaving sentiment washed out and valuations compelling.

Natural gas, by contrast, is already in a different phase of the cycle. Gas has rapidly become one of the dominant sources of utility-scale energy. After entering a clear bull market, natural gas prices underwent a sharp correction in the last couple of weeks, but the setup still favors another leg higher. Storage trends, expanding LNG exports, colder-than-normal seasonal patterns, and surging electricity demand from AI data centers are tightening the market faster than expected.

With US LNG export capacity set to expand meaningfully and domestic demand rising, natural gas has become a structurally bullish story. The divergence, oil potentially bottoming while gas remains in a bull trend, creates an attractive risk-reward backdrop across the energy complex.

Gold and Bitcoin: Alternatives in an Uncertain World

Gold has quietly delivered a remarkable run, rising nearly 70% this year and more than doubling the S&P 500’s return since the start of the AI boom roughly three years ago. That performance is discussed surprisingly little, which itself suggests gold remains under owned. Investor reactions to gold tend to be polarized, ranging from ardent gold bugs to purists who dismiss any asset without earnings. In reality, gold’s role is more nuanced. It functions best as a portfolio diversifier rather than a growth asset.

Bitcoin occupies a similar psychological space. It also provokes emotional reactions, yet it too has emerged as a legitimate and increasingly important diversifier. Both assets reflect the broader and somewhat uncomfortable reality that the world has become markedly more uncertain. From a portfolio construction standpoint, guarding against what can go wrong has become more important, and historically, gold has been one of the most effective hedges against complex risks.

Despite the lack of retail enthusiasm, gold clearly has strong buyers. Central banks and more recently, large institutions have returned aggressively to the metal. Gold performed well through COVID and has gained renewed appeal amid rising geopolitical tensions.

Morgan Stanley CIO Michael Wilson recently argued that the traditional 60/40 stock-bond portfolio no longer reflects today’s market realities and suggested a 60/20/20 approach, replacing half of the bond allocation with gold. As Wilson put it, “Gold is now the anti-fragile asset to own, rather than Treasuries. High-quality equities and gold are the best hedges."

Yet retail investors remain largely disengaged from the gold discussion. That lack of enthusiasm is itself a constructive signal. Historically, gold bull markets tend to peak only after widespread retail excitement. When newcomers begin loudly touting gold at new highs, that will be a reason for caution. That phase appears some distance away.

Bitcoin has emerged as a parallel alternative for hedging risk while also offering higher return potential. The “digital gold” narrative is increasingly compelling.

In just over a decade, Bitcoin has moved from an obscure experiment to a holding recommended by the world’s largest asset managers. It serves as an alternative store of value with overlapping catalysts to gold, remains insulated from direct government manipulation, and increasingly acts as a release valve for global liquidity.

While future returns are unlikely to match the multi-hundred-percent gains of earlier years, Bitcoin still appears early in its adoption cycle.

It’s worth noting that Bitcoin has never had two consecutive years of annual losses.

Healthcare

Healthcare stocks delivered meaningful outperformance in the final quarter of the year, driven by a combination of defensive rotation and genuine fundamental improvement. As volatility increased, investors gravitated toward sectors with stable demand and earnings visibility. Importantly, even as volatility has eased, healthcare names have held their gains and appear well positioned to resume their advance after consolidating near recent highs.

The Healthcare ETF (XLV) posted standout relative performance versus nearly every other sector over the past three months. Three-month relative momentum is among the more reliable short-to-intermediate forward indicators in markets, and in this case it appears supported by fundamentals that can extend into next year rather than fade quickly.

Image Source: Zacks Investment Research

Defensive demand, improving earnings visibility, regulatory clarity, and AI-enhanced productivity, healthcare’s recent strength looks structurally supported. Momentum is strong, but importantly, it is being carried by fundamentals that suggest durability rather than exhaustion.

What Can Investors Expect in the Year Ahead

The investment backdrop heading into 2026 remains constructive. While volatility and periodic drawdowns are inevitable, the core drivers of the bull market remain firmly in place. Leadership is broadening, earnings growth is improving beyond mega-cap technology, and multiple sectors are setting up for durable advances.

For investors, the opportunity is less about predicting short-term market moves and more about aligning with the dominant forces reshaping the global economy. AI-driven productivity gains, the re-pricing of energy and power assets, and improving fundamentals in historically cyclical sectors all point to a market rich in opportunity.

As promising as these trends are, it’s important to identify the companies with the highest probabilities of outsized gains.

That's why we've just released our new Special Report, 2026 Profit Predictions: 4 Big Opportunities. It explores the surprising stocks we believe will skyrocket in the new year and explains the cutting-edge advancements and key catalysts that make them impossible to ignore.

Looking back at this year, our team closed gains such as +499%, +1,340% and +2,027%.¹ Our latest recommendations may be just as lucrative.

Today you can access the 2026 Profit Predictions Special Report today for just $1. When you do, you'll also get 30-day access to all of Zacks private portfolios for the same dollar.

We're limiting the number of investors who can download our Special Report, so don’t delay. This opportunity will end midnight Saturday, December 28.

Download 2026 Profit Predictions and check out Zacks' portfolios for 30 days for just $1 >>

All the best,

Ethan

Ethan Feller is a Stock Strategist with more than a decade of experience. He invites you to access Zacks 2026 Profit Predictions to learn more about the trends and trades Zacks expects to dominate the new year – for a total cost of only $1.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position. Access grants you a comprehensive list of all open and closed trades.